Authors:

Kirk Harmon, Vice President & GM, Contract Sales Organization, IQVIA

Javier “Jave” Castillo, R.Ph, Vice President, CSO Strategy, IQVIA

Is it Time to Transform Your Commercial Model?

The MedTech industry is operating in a dynamic environment amid continued product innovation, greater adoption of less invasive procedures, and the aging population. MedTech enterprises are also navigating macroeconomic pressures as they work to maintain coverage for key healthcare providers (HCPs) — while expanding support for Ambulatory Surgery Centers and other alternative sites of care.

Given these conditions, meeting profitability goals requires tremendous agility. MedTech companies are exploring new business models to increase profitability and accelerate time-to-market. For a growing number of MedTech organizations, the contract sales organization (CSO) model is proving to be a powerful tool for achieving greater speed and higher performance.

For nearly 30 years, IQVIA has been providing sales, clinical, and other customized resources to enhance MedTech companies’ go-to-market strategies. What follows are just three scenarios where leading MedTech manufacturers have partnered with IQVIA CSO to transform their commercial models and drive continued growth.

Reason #1: “Our distributors can’t give us the focused support we need.”

Given the rapid pace of innovation, MedTech companies need fast, flexible, and diverse teams at launch and beyond. The traditional distributor model can meet some needs, but distributors typically offer only sales professionals — who support multiple devices and/or brands and may lack focus on your organization’s specific product and priorities.

Unlike the traditional distributor model, a high-quality CSO partner provides tailored solutions and resources that are fully dedicated to a single manufacturer. These collaborations enable your organization to maintain 100% control over promotional efforts and offer access to experienced clinical and operational support resources as well as seasoned sales representatives. Ultimately, a CSO partnership gives device and diagnostics companies much greater flexibility to adjust as local market dynamics, promotional requirements, and HCP needs evolve.

Reason #2: “We’re not getting enough referrals.”

Some healthcare innovations improve an existing approach; others forge an entirely new paradigm that results in changes to standards of care. As those changes take shape, manufacturers of life-changing treatments may struggle to reach the patients who most need them. Often, that’s due to lack of awareness among patients and/or HCPs who could refer them to the appropriate implanting physicians or surgeons.

Quite simply, patient journeys don’t typically start with surgeons. Yet when specialized, highly compensated medical device sales professionals rightly focus on end users — the surgical interventionists — they have little bandwidth to nurture relationships with potential referrers. Thus, for MedTech organizations, it can be challenging to drive sustained success after the initial bolus of patients is introduced to their products.

That’s where a CSO partner with therapy awareness managers can help. A high-quality CSO partner will use data analytics and insights to identify non-interventionalist targets and existing referral patterns. Relatively cost-effective therapy awareness managers will then take responsibility for driving education and awareness, identifying potential patients, and fostering behavior change — ultimately increasing referrals to interventionalists or surgeons.

IQVIA recently partnered with a device manufacturer to pilot a team of therapy awareness managers. Following initial rapid success in increasing referrals, the team was expanded and has driven a 150% increase in year-over-year patient referrals.

Reason #3: “We’re overspending on relatively low-value activities.”

Launching any innovative device or technology requires highly specialized sales teams. Indeed, these sales professionals are the costliest promotional resources, and many MedTech sales leaders face challenges in where and how to deploy them.

To answer surgeons’ questions about the devices they are using, MedTech sales representatives are typically in the operating room (OR) for surgeries. But once surgeons have a high comfort level using a device, covering cases in the OR can become a distraction from other revenue-driving activities. Similarly, administrative tasks, such as managing inventory and purchasing, are essential, but can become another drag on a representative’s ability to focus on revenue generation.

Economic pressures make it difficult or impossible to hire more highly paid sales representatives. A CSO model offers a solution in the form of case coverage representatives. These relatively cost-efficient professionals step in to handle common cases where the surgeon is already familiar with the equipment and procedures.

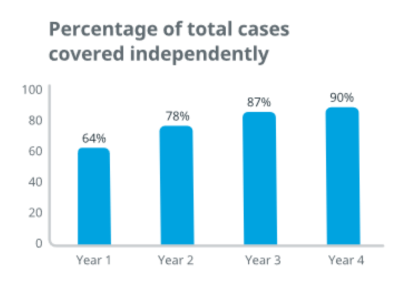

IQVIA collaborated with a medical device manufacturer seeking a better approach to case coverage. The goal was for IQVIA-hired case coverage representatives to cover 80% of cases independently within nine months. They ended up handling more than 90%, freeing the manufacturer’s sales consultant to drive new business. Additionally, the company has increased sales while reducing expenses and improved overall agility with the ability to flex up or down depending on needs. With the case coverage managers, the manufacturer is also building a strong bench of future sales consultants.

Drive growth, optimize margins with a tailored CSO solution

Healthcare innovations will continue to drive life-changing — and paradigm-shifting — treatments. Keep pace with a CSO collaboration that reflects your MedTech organization’s unique needs. Don’t settle for a one-size-fits-all solution. Instead, look for a partner like IQVIA that tailors every relationship with the right mix of resources (sales, clinical, and/or operational), the right mode of deployment (in-person field, virtual, or hybrid), and the right data-driven insights for guiding engagement. Contact us today to see how we can help.